Product no longer available.

This product is no longer available for purchase. Please contact us if you have any questions.

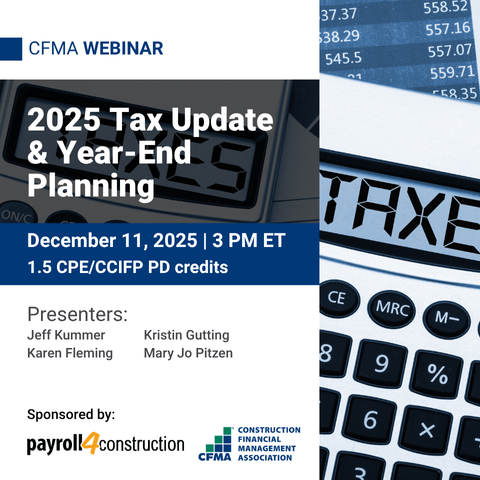

2025 Tax Update & Year-End Planning

December 11, 2025 at 3:00 PM EST (12:00 PM PST) - December 11, 2025 at 4:15 PM EST (1:15 PM PST)

$0.00

Purchasing on behalf of another customer?

If you are interested in purchasing a product on someone's behalf or need to place a bulk order, please contact CFMA Education at education@cfma.org or call 609-452-8000, press 3 for Education.

CFMA’s 2025 Tax Update & Year-End Planning

Thursday, December 11, 2025

Join us for a federal tax update exploring the current landscape of the Internal Revenue Service (IRS). Our presenters will address timely questions about what to expect following the recent government shutdown, including developments in IRS examinations, penalty enforcement, and emerging procedural challenges. Attendees will gain insight into what lies ahead after the enactment of the One Big Beautiful Bill Act (OBBBA), along with an overview of key tax policy issues that might be on the table as we approach year-end. Finally, we’ll look ahead to 2026 and discuss how the midterm elections could shape the future of tax legislation and policy.

Learning Objectives

- Identify the current state of affairs in the legislative branch, with an eye toward the 2026 midterm elections.

- Gain insights into the current operations of the U.S. Department of the Treasury, including IRS audit activity and expectations post-government shutdown.

- Learn about general tax updates from the OBBBA and year-end planning perspective.

Prerequisites

CPE Credits

CPE/CCIFP Information

Course Length

Who Should Attend:

Business Owners

CFOs

Controllers

CPAs

Professional Advisors

Risk Managers